Expatriate Social Insurance in China: What Happens After 1 July 2011?

In the months since the promulgation of the PRC Social Insurance Law in October 2010, employers of expatriate workers have become increasingly concerned on how the new law will impact their business. The law states that rules on mandatory contribution of social insurance apply not only to Chinese employees but also to expatriates, including those working on a local contract and those dispatched to China by their headquarters to work at the Chinese subsidiary or office. As existing social insurance contributions are a hefty chunk of an employer’s salary costs, what will the effectiveness of the law in July 2011 mean to foreign business in China?

A proper answer to this question consists of two parts. First, recent articles have implied that as of 1 July 2011, costs will immediately go up. However as we will explain, this is unlikely to be the case. Second, what does the law mean in monetary terms? This also remains to be seen, though thankfully the impact is going to be less than many companies fear.

Implementation

The law is clear: Foreigners employed within the territory of the People’s Republic of China (include people from Hong Kong, Macau and Taiwan) shall participate in social insurance analogically in accordance with this PRC Social Insurance Law (Article 97). Realistically speaking however, the country is not ready to immediately charge social insurance premiums to the 600,000 expatriate workers that were counted during last year’s census, and their employers. Social insurance contributions are not dealt with at state level in Beijing but arranged at local levels, and so labor departments will have

to come up with implementing rules. So far however, they have been waiting for guidance.

Such guidance is coming. On 10 June, the Ministry of Human Resources and Social Security released the Draft Interim Rules for the Participation in Social Insurance of Foreign Employers in China (Draft for Comments). These draft rules, if promulgated in their present form, confirm that all foreigners employed in China and their employers should contribute social insurance “in accordance with relevant regulations”, and this includes citizens of Hong Kong, Macau and Taiwan. The rules also clarify that pensions for departed foreigners will be retained, and that upon expiry of the 25 year pension period, or earlier when the foreigner leaves China, the foreigner can apply for pay-out. However, the rules do not contain other important details on the kinds of premiums that foreign employees and their companies will have to contribute to, and whether pay-outs will be arranged in the same way as Chinese employees.

What is needed to make the law applicable? Social insurance is collected locally, and therefore local departments will have to establish systems, and issue implementing rules, to enable employers to deduct social insurance contributions from expatriate employees’ salaries, and to pay additional contributions. So far, these systems have not been put in place. Moreover, these departments will also have to spend time enforcing the new rules. To draw a parallel, for several years now contributions have been mandatory for employees from Hong Kong, Macau and Taiwan, however this has not been widely enforced.

Costs

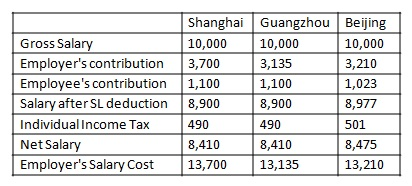

It is likely that in due time and in some form or other, social insurance contributions will start to be collected for foreign employees. The rates may or may not be the same as for Chinese employees, but in any case will be determined locally. At present for example, Shanghai employers have to pay an additional 37% on top of the employee’s gross salary (before tax), and their employees have to pay 11% of their salary in premiums (before tax). The below table shows the contributions (in CNY) for an expatriate with a salary of CNY 10,000, based on the present contribution schemes:

Cap of Calculation base

Currently, the basis for calculation for Chinese employees is capped at three times the average salary in a certain district or municipality. It is presumed that the same cap will apply for foreign employees, which would be good news: no matter how high an expatriate’s salary is, the costs of social insurance contributions to the employer and the employee would be capped as well. In Shanghai for example, the average salary in 2010 was CNY 3,986, which means that the social insurance basis is capped at CNY 11,958. On this basis, the maximum contributions for employer and (foreign) employee in Shanghai would be CNY 4,424 (approx. USD 700) and CNY 1,315 (approx. USD 200) respectively.

Conclusions

1 July 2011 will probably be just another day, but social insurance contributions will probably have to be made for expatriates working in China in due time. If these contributions match those for Chinese employees, then this can be a considerable cost, especially to companies that employ many foreigners, and to those that employ relatively young foreigners – as social insurance will be a relatively large part of total salary costs.

On the other hand, we believe that in practice, cost is not a main consideration for companies to choose between foreigners or Chinese. Moreover most salaries of foreign workers are comparatively high, which means that proportionally speaking, the cost of social insurance is relatively low – since the basis of social security contributions is capped at three times the average salary of a municipality. Therefore the impact on foreign business in China should be very limited.

It will take some time before the rules are implemented, but once this happens, the biggest impact may be on young foreigners that come to China to find local jobs in business development, design, or the F&B industry. Many foreigners nowadays come to Shanghai and Beijing in particular to start their career; employers will have to either accept the additional burden, not pay (all of) the additional cost (e.g. pay employees part of their salary “black”) and risk being penalized, or ask the foreigners to take a pay-cut for the opportunity to develop in China. That may be a small price to pay, to be part of China’s development.